In the early hours of January 2, 2017, the value of the digital currency known as Bitcoin passed the 1,000 USD mark for the first time in over three years. This makes it more than 250 times more expensive than the Kuwaiti Dinar, which is conventionally considered the most valuable national currency in the world.

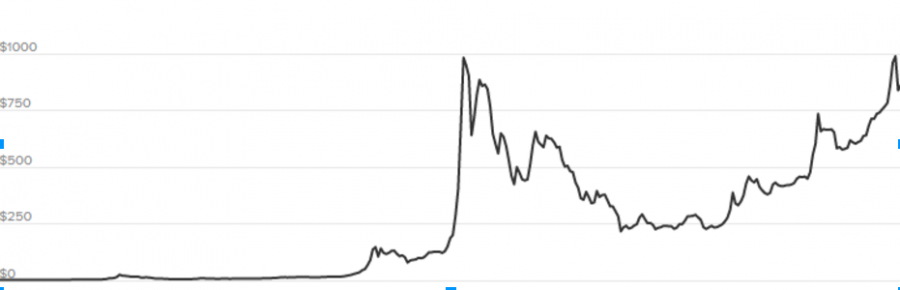

Bitcoin was launched in January 2009 by an unknown founder using the name Satoshi Nakamoto, whose identity still remains a mystery. At its inception, according to Investopedia, Bitcoin’s initial value was USD $0.008, or less than one cent, but within five days, a Bitcoin was worth 8 cents, and its USD value continued to increase rapidly over the next few years, rocketing into the hundreds. What sets Bitcoin aside from other currencies is the fact that it does not physically exist; there is no such thing as a Bitcoin note or a Bitcoin coin. All transactions are conducted over the Internet, and are not backed or regulated by any country’s government.

Bitcoin has recently made inroads into Taiwan, led by two competing startups called MaiCoin and BitoEX. Deals with these two companies have made Bitcoin available for purchase at the multi-purpose kiosks of over 12,000 convenience stores around the country, including popular chains like 7-11, Hi-Life, OK-Mart. FamilyMart has also begun to accept Bitcoin as payment for cash vouchers at their stores. In addition to these convenience stores, according to CoinMap, 18 businesses in Taipei accept Bitcoin for their goods and services, including 12 Baskets, the largest producer of agricultural products and artistic crafts in eastern Taiwan, and BeerBicycle, a bicycle shop/bar in Wanhua.

Despite this, Dr. Bruce, AP Economics teacher, expressed doubt against Bitcoin becoming more mainstream in the future. He says, “the essence of a viable currency is that it is widely accepted by all as a medium of exchange, has a stable value, and is subject to monitoring and control by a central bank. Bitcoin currently fails all three of these characteristics.” Bitcoin’s expansion has faced opposition from the Taiwanese government; according to CoinDesk, the Taiwanese government has stated that it will not be allowing the installation of Bitcoin ATMs, and has required banks not to receive or exchange Bitcoin.

In the last 12 months, Bitcoin has experienced a record year, more than doubling in price. The main cause behind this resurgence was the weakness of the Chinese economy, causing investors to try to move their money abroad. Government regulations prevented Chinese citizens from doing this through traditional methods, leading them to turn to the unregulated Bitcoin instead. Driven by this factor, Bitcoin reached US$ 1,153 on January 4th, within touching distance of its all time price high.

In the latest twist in Bitcoin’s rollercoaster story, though, the very next day, the Chinese yuan showed signs of strengthening, causing the currency to rapidly drop by nearly three hundred dollars. Regardless of these movements, Dr. Bruce remains skeptical of Bitcoin’s status as a viable investment, saying that “I would categorize Bitcoin as a highly speculative investment, possessing a disproportionate amount of risk. It certainly doesn’t fit within the traditional parameters governing investing, and its lack of transparency and oversight makes it a ‘buyer beware’ situation.”

![TAS upperclassmen volunteers helped

guide guests at the fair. Volunteers were

also involved in the set-up and clean-up

processes. [VICTORIA HSU/THE BLUE & GOLD]](https://blueandgoldonline.org/wp-content/uploads/2023/12/DSC05845-1200x798.jpeg)

![The film team poses for a group photo in Central Park. [ERIN WU/THE BLUE AND GOLD]](https://blueandgoldonline.org/wp-content/uploads/2023/12/film_5782-1200x900.jpeg)

![The last prom was held in 2020. [PHOTO COURTESY OF ELAINE H. (‘21)]](https://blueandgoldonline.org/wp-content/uploads/2023/05/prom.jpg)

![Students watched their classmates graduate in 2022. [PHOTO COURTESY OF TAS COMMUNICATIONS]](https://blueandgoldonline.org/wp-content/uploads/2023/05/grad-900x599.png)